By the end of 2021, the marketplace for non-fungible tokens, which are digital pieces of art tied to blockchain technology, reached a $41 billion value, according to blockchain data company Chainalysis. Heated fundraising such as Bored Ape’s Yuga Labs also raised US$450M in funding. However, every hype has its end and will eventually back to the fundamentals, and that includes NFTs. This article will discuss the life cycle of NFTs, and what is missing in the NFT industry.

Life Cycle of (Profile Picture) NFTs

To understand the crypto community’s pessimistic view on profile picture NFTs (PFP), one must understand the life cycle of an NFT. The life cycle of NFTs could be extremely short, particularly for those without fundamental values (“firstness”, rarity, utility, and history of ownership; for more details, please refer to the previous article “Introduction of NFT”). An NFT could pop up from nowhere and become the talk in crypto communities and then lose the market’s attention within a week.

- Day 1 – Excitement: The market is hyped about a new NFT

- Day 2 – FOMO: Everyone rush into the market due to the fear of missing out (FOMO)

- Day 3 – Inaction: After the hype, the market goes quiet

- Day 4 – “FUD”: The participants in the community are under the condition of fear, uncertainty, and doubt (FUD) due to the latest development (or the lack of development) of the project

- Day 5 – Out of Control: Community members have become hysterical regarding the NFT project and try to propose suggestions to the development team

- Day 6 – Hopelessness: NFT holders realize that it is extremely difficult to resell the NFT in the secondary (let alone recoup their investment)

While the life cycle mentioned above seems dramatic, it is a real case in the crypto market. The NFT collection is called Solana Monkey Holiday (SMH) listed on Magic Eden. The collection is a typical PFP NFT. Although the collection was hyped at first partly due to its similarity to the acclaimed Solana Monkey Business series (SMB), which is a premier blue chip PFP NFT project on Solana with a floor price of 234 SOL, it is obviously a copycat of SMB and the hype was quickly plummeted because of the lack of fundamental value.

Obviously, not every PFP NFT collection will experience the same level of decline in popularity as the case mentioned. Prolific ones like the BAYC collection and Cryptopunk backed by Yugas Labs are most likely to maintain their value due to qualities like “firstness” and rarity but we expect a deceleration if no further value acquisition is created.

What is missing in the NFT Industry?

1. Token Standard and Programmability

The beauty of smart contracts enables programmability, thus creating a trustless and decentralized environment for both creators and investors. In fact, there are quite a lot of NFT standards in the crypto space. Currently, the most used ones for NFT are ERC-721 but there are also ERC-1155 (fractionalized NFT), ERC721-R (refundable ERC721), ERC-998 (Composable Non-Fungible Token Standard), ERC-4610 (liquidity protocol for gaming NFT assets).

The usage of different token standards and token standard development is laggard. It is hard for the general public not to think of “NFT is just a JPEG”. It fails to provide a “wow” or “ah-ha” moment with blokchain technology. The potential of NFT is not fully unleashed.

Recently, more prolific NFT collections, such as the Azuki (#40 Bobu Token) and the Adidas Originals: Into the Metaverse (ITM), have adopted the NFT standard ERC-1155. The ERC-1155 standard is relatively less common among well-known NFT collections, whereas the ERC-721 standard is used more generally.

What makes the ERC-1155 standard stand out is its nature of both fungibility and non-fungibility. In short, an ERC-1155 token can have multiple owners and the standard enables users to transfer multiple token types at the same time without having to authorize individual contracts.

From the marketing or branding perspective, you can think of it as a pre-requisite or necessary gear required to challenge the boss in an MMORPG game. In other words, only frens with a high participation rate who have successfully finished all the 4 stages can eventually get whitelisted and get their finally ERC-721 token. This will build up tremendous branding and customer loyalty around the NFT holder community.

2. NFT cross-chain compatibility (Join Discord & DM for full report)

Beyond the token standard within a blockchain, cross-chain brings even greater problems such as data integrity, metadata structure and incompatibility when bridging or wrapping cross-chain. It is also the infrastructure required for an open metaverse that metaverse are inter-connected envisioned by Animoca Brands.

3. NFT pricing (Join Discord & DM for full report)

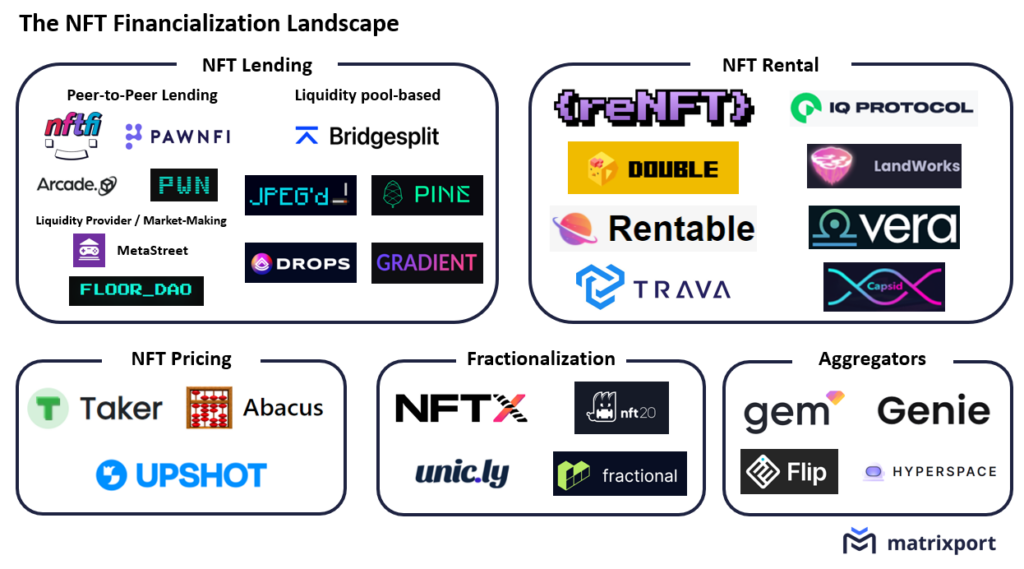

To achieve a relatively efficient NFT market and enable NFT financialization, NFT pricing is the most crucial infrastructure and primitive. By nature, NFTs are hard to price since they are non-fungible and the evaluation of NFT is manifold such as utility, rarity, celebrity, community and originality (for more details, please refer to our NFT Evaluation article). What’s more, there is insufficient historical data, lack of liquidity, volatile and even vulnerable to market manipulation.

Conclusion

While an overwhelming amount of profile pic NFTs are short-lived and will drop to near zero, the “Original Gangsters” (OG) will be here to stay with a blend of the mechanics in the traditional art market, auction house and branding, marketing strategies.

With the NFT infrastructure continuing to build up, the dots between NFT infrastructure and applications like metaverse will eventually be connected. We envision an open and borderless metaverse where users can read, write and own the digital assets, an interoperable, standardized, efficiently priced and cross-chain compatible NFT is required.

Besides, we are witnessing and experiencing the evolution of the token standard that enables greater flexibility and utilities of NFT. Apart from Adidas Originals Into the Metaverse, Azuki’s Bobu actually also use ERC-1155 as the token standard and create an interesting narrative driven by the Azuki community. Fractions of Bobu create an opportunity to co-create, decentralize decision making, step by step, until the management of Bobu’s IP is one day fully in the hands to the community. It is exciting to see how ERC-1155 token standard as an infrastructure to further unleash the potential of NFT and apply it to more areas.

Lastly, many projects and protocols have taken up the challenges and are working towards solving them as well as bringing innovation. We are de facto stepping forward to open, trustless and permissionless networks in web3.

By Ezreal Kung and Arthur Kwon at Art of Trades

Join our professional community: https://discord.gg/vQ86KykhM2

—

Disclaimer

Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. The content created by Art of Trades is for educational and informational purposes only and should not be construed as professional financial advice. Investing in cryptocurrencies is highly risky and speculative, and this article is not a recommendation by Art of Trades or the writer to invest in cryptocurrencies. Please do your own research and use your own judgment before investing. We shall not be liable for any losses that may arise from your use of the content created by Art of Trades.

Art of Trades is not a financial institution and does not provide any financial products or services. The publishers of Art of Trades are not brokers, dealers, or registered investment advisors and do not attempt or intend to influence the purchase or sale of any security. Art of Trades makes no representations or warranties as to the accuracy or timeliness of the information contained herein. Art of Trades and the author may or may not own cryptocurrency.