O’Neil Methodology

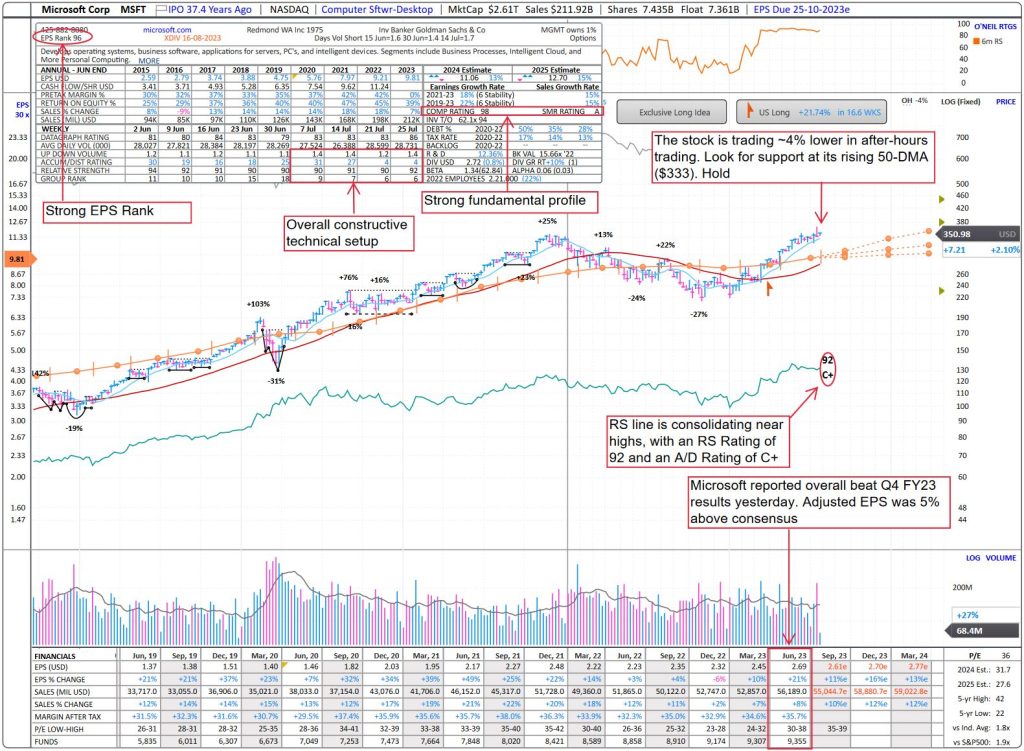

– The stock is down ~4% in after-hours trading. The next level of support is near ~$333 (50-DMA). Hold.

– Strong fundamental profile: EPS Rank 96 and SMR Rating of A.

– Technical setup: RS line is consolidating near highs, with an RS Rating of 92 and an A/D Rating of C+.

Commentary

– Microsoft reported beating profitability in the Q4 FY23 results yesterday after market close. We recommend that investors hold positions. The stock is down ~4% in after-hours trading. The next level of support is near ~$333 (50-DMA).

– Revenue increased to $56.2B (+8% y/y), in line with consensus, and adjusted EPS increased to $2.69 (+21% y/y), beating consensus by 5%, driven by a 132bps beat on adjusted operating margin, which rose 357bps to 43.2%. Azure growth came in at 27% y/y in constant currency (26% y/y in actual growth), in line with consensus.

Segment Performance

– Productivity (32% of total; +10% y/y): Revenue of $18.3B was in line with estimates, and operating income of $9.1B (+25% y/y) was 7% above estimates.

- Dynamics products and cloud services revenue increased 19% y/y, driven by Dynamics 365 growth of 26% y/y.

- Office Commercial products and cloud services revenue increased 12% y/y, driven by a 15% y/y growth in Office 365 Commercial revenue (seat growth of 11% y/y).

- LinkedIn revenue increased 5 % y/y.

– Intelligent cloud (43% of total; +15% y/y): Revenue of $24.0B was in line with estimates and operating income was $10.5B (+19% y/y), 6% above estimates.

- Server products and cloud services revenue increased 17% y/y, driven by Azure and other cloud services revenue growth of 26% y/y (up 27% y/y in constant currency).

– Personal computing (25% of total; -4% y/y): Revenue of $13.9B was 2% above estimates, and operating income of $4.7B (+4% y/y) was 6% above estimates.

- Windows OEM revenue decreased 12% y/y primarily, driven by continued PC market weakness, partly offset by roughly 7ppts of benefit from early back-to-school inventory builds.

- Devices revenue decreased 20% y/y. Windows commercial products and cloud services revenue increased 2% y/y.

- Xbox content and services revenue increased 5% y/y.

- Search and news advertising revenue, excluding traffic acquisition costs, increased 8% y/y.

Guidance:

– Q1 FY24 guidance: Management expects revenue of $54.3B (+8% y/y), slightly below consensus of $54.8B, and operating income of $24.1B (+12% y/y), above estimates of $23.6B.

- Azure revenue growth to be sequentially lower at 25.5% y/y (on a constant currency basis) with a 2ppts contribution from AI services, in line with consensus expectations. The company expects the majority of AI-related growth to be back-ended (H2 FY24), partially driven by Microsoft 365 Copilot moving to General Availability by then.

- Expects FX to increase total revenue growth by ~1ppt with no impact to COGS and a 1% increase to operating expense growth.

– FY24 guidance: Expects operating margin to remain flat y/y.

Additional points/Concall highlights:

- The company expects cost-optimization in cloud spending to end over the next two quarters.

- Capital expenditure in Q4 of $10.7B (+37% q/q; +23% y/y) is broad-based across data centers, CPUs, and GPUs.

- More than 11K organizations across industries use Azure OpenAI Service, with nearly 100 customers added every day last quarter.Mercedes-Benz is bringing ChatGPT via Azure OpenAI to more than 900K vehicles in the U.S.

- Microsoft Fabric: Over 8K customers have signed up to trial the service and are actively using it, and over 50% are using four or more workloads.

- GitHub Copilot: More than 27K organizations, up 2x q/q, have chosen GitHub Copilot for business.

- The new Microsoft Sales Copilot enables sellers to ingest data from CRM systems, including both Salesforce and Dynamics, to personalize customer interactions and close more deals.

- Microsoft is rolling out Microsoft 365 Copilot to 600 big customers through their Early Access Program.

- Teams Premium has surpassed 600K seats in five months.

- Microsoft Viva has 35M monthly active users.

- Security products: Have 1M+ organizations using Microsoft’s security solutions with 60+ customers using 4+ products.

- In identity, Microsoft Entra ID has more than 610M monthly active users.

- Microsoft extended the Activision Blizzard merger agreement deadline to October and remains confident of closing the deal.